This post is all about using Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum to teach your teens financial literacy.

This is a sponsored post and My Homeschool with a View, LLC was compensated to review and write aboutBeyond Personal Finance Teen (13+) Self-Paced, Online Curriculum. For more information on sponsored posts, read our Affiliate and Advertising Disclosure. Thank you to Beyond Personal Finance for sponsoring this post and providing Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum for review!

One of my most important homeschool goals as I prepare my two high schoolers for adulthood is teaching my teens financial literacy. This is actually one of the top priorities in our household, and should be in any home that has teens.

Our new favorite tool for teaching teens financial literacy is Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum. My teens started on this course as soon as it arrived.

Teaching our kids about business, entrepreneurship, and managing finances have always been part of our homeschool. This course introduced my teens to some of the realities of the job market, entry level employment, and college debt in a real way.

In this post, you will learn why you should teach your teens financial literacy, and how to use Beyond Personal Finance to teach teens financial literacy using real life scenarios.

Teens Financial Literacy

1. Building Teens Financial Literacy

This may seem obvious since this post is all about why you should teach financial literacy. But it is actually a really important point.

Giving our teens the tools to take the information given and building upon it is an important reason to teach teens financial literacy. It empowers them to create their own financial plans, values, and goals.

The 20 video based lessons in Beyond Personal Finance cover all four pillars of financial literacy: Debt, budget, saving, and investing. Charla McKinley, the course creator, teaches these four pillars in a realistic way. Students actually choose a career with a realistic income and basically build their future through the course.

2. Exploring Career Paths

The very first of these financial literacy lessons for teens had my kids exploring career options, including education level, salary, and job availability.

The student portal, which is where you will find the teaching videos and extra resources, connects teens to ONET to explore different career opportunities.

One of the things I really appreciate about this lesson is that Charla McKinley doesn’t emphasize a one-size-fits all path to future careers. Most courses focus on the going to college, graduating, and getting a job pathway to adulthood. Beyond Personal Finance also encourages exploring trades and entrepreneurship in addition to the more conventionally taught path to future success.

3. Planning for the Future

I watched my oldest have an eye-opening, ah-ha moment when choosing a career and calculating a starting salary. See, a lot of times we tell our teens to pursue a career path with high income potential. While this may be good advice, we often leave out the part that even with a degree, you don’t start at the top of the salary range.

This was such an eye opening lesson for my oldest. When he started digging into college costs vs. what you make starting out in a given field, he was pretty shocked. Even more shocking was when he began trying to apply his student loans and starting salary to a budget.

Getting to learn this lesson through an engaging homeschool curriculum, instead of in real life with real money at stake, is invaluable. While he is learning many important lessons from this calss, if that was the only take away he got from Beyond Personal Finance it would still be worth it.

All you have to do is turn on the news and it is obvious that there are hundreds of thousands of college graduates that weren’t taught this lesson until real money was involved. It is an expensive and sometimes extremely harsh lesson to learn in real life. Let’s spare our kids this ton-of-bricks reality and let them learn with Beyond Personal Finance.

Personal Finance for Teens

4. Learning How to Budget

I am always surprised at how many adults don’t know how to budget. In fact, a lot of adults have no idea how much things cost or what they spend on a monthly basis. It is no surprise that a lot of these adults live from one personal financial crisis to the next.

Our teens need to learn this important life skill. The budgeting tools included in the course give a realistic perspective of income and expenses. The real life application of building a budget even has our teens figure out if they need to build in some extra overtime to meet their financial needs.

This real-life approach to learning financial literacy is giving my teens a unique perspective that I think will put them ahead of the game in the future.

5. Managing Credit Cards

You have probably heard certain financial gurus shouting from the rooftops, telling people to cut up their credit cards. You don’t need them. Just say no to credit cards.

I appreciate that Beyond Personal Finance doesn’t teach complete credit avoidance. Charla McKinley, the author and instructor, emphasizes responsible use of credit cards. Which leads me to my next point.

6. Building a Positive Credit History

Following the fear based advice saying not to ever use a credit card almost prevented me from buying my first home. True story! So while care and discipline are in order when it comes to using credit, building a positive credit history is important.

This section of the course was a breath of fresh air to me as it aligned with what I have learned over the years about credit.

Charla McKinley doesn’t assume that our teens are incapable of being responsible with credit. Emphasizing instead the importance of using credit responsibly and for things that really matter.

7. Understanding Credit Scores

Just like building a positive credit history, this course does an excellent job of explaining how to use credit cards in a way to build a credit history and credit score.

Love it or hate it, credit scores are important and our teens need to learn how to build theirs.

In addition, the class also explains the potential pitfalls and self-discipline required to build a positive credit history.

8. Encouraging Saving Habits

The realistic financial literacy activities teens presented in Beyond Personal Finance helped my teen understand the importance of preparing for his future now. This includes saving money while he is still living at home with no expenses.

Realizing that moving out and living on his own in a few years takes more than just needing a job and a paycheck, is a reality check. He has to consider things like deposits, or even a down payment for a house. This is helping him develop a balance of spending on fun stuff, he is a teenager after all, and saving now to set himself up for the future he wants.

9. Understanding the Value of Money

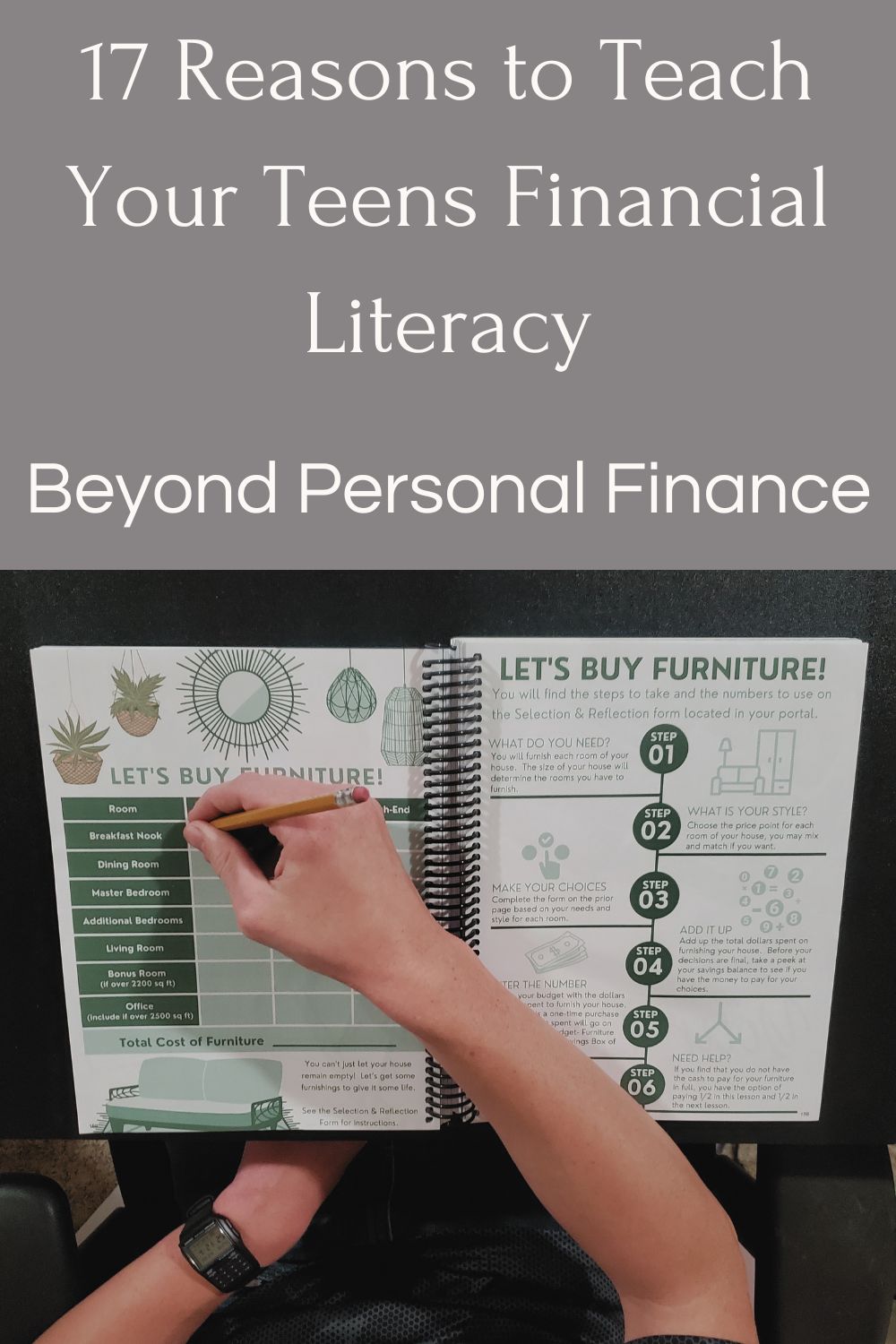

Beyond personal finance walks teens through every detail of budgeting, buying a car, and purchasing a house. All while also considering insurance, paying bills – all of the grown up things. It gives them the opportunity to see how quickly money gets used just by life necessities.

I don’t know if teens living a carefree life, courtesy of their parents, can ever fully understand the value of money. That being said, this course encourages them to treat the assignments like real life scenarios. It gives them the best taste and appreciation for the value of money.

10. Promoting Responsible Spending Through Teens Financial Literacy

Teens are encouraged to budget and spend wisely, but this curriculum doesn’t discourage them from enjoying their life. Instead they are encouraged to add reasonable wants into their budget. Creating a balance of needs, wants, and savings makes them more likely to stay on budget. This is really another example of how this program presents real life examples for our teens to follow.

11. Understanding Taxes

While my oldest works a seasonal job and we’ve helped him file his own taxes, I’ve noticed that high schoolers aren’t necessarily getting traditional jobs anymore. At least it is happening in fewer numbers than when I was a teenager.

Charla McKinley walks teens through filing income taxes. Teens fill in the accompanying assignment in the workbook, learning about deductions, taxable income and even charitable donations as they complete the assignment.

12. Reducing Financial Stress

This program is all about navigating real life financial challenges in a non-real world setting. We are giving our teens the knowledge and confidence that can carry them through challenging situations they may face in the future.

Beyond Personal Finance throws curveball scenarios at them, such as job loss and divorce. As much as we hope for good things for our kids as they enter adulthood, we all know that life takes unexpected twists and turns sometimes.

We don’t need to shelter or pretend that they will never be faced with these real possibilities. Teaching them to structure their financial lives in a way that provides a safeguard can help them confidently walk through the difficulties they may face in life.

Financial Planning for Teens

13. Encouraging Investment Knowledge

Beyond Personal finance introduces concepts of investing to grow wealth. The course gives a basic overview that includes risk tolerance, assets, portfolios, stocks and bonds, 401K and other investment accounts.

The course gives a high level overview of this topic. The student portal includes extra resources for families that would like to dive deeper into this subject.

14. Enhancing Decision-Making Skills

Beyond Personal Finance enhances decision-making skills by providing a comprehensive, interactive platform that simulates real-life financial scenarios.

It immerses our kids in various financial situations. This is everything from budgeting and investing to managing debt and planning for retirement.

By navigating these financial literacy lessons for teens, they gain practical experience. Teens learn the consequences of their financial choices in a risk-free environment.

15. Empowering Independence

Learning to build their own budget, file their own taxes, and navigate financial decision making empowers independence. Encouraging self reliance and personal responsibility by is key in teaching teens financial literacy.

As difficult as it feels to launch our kids into the real world, I want my kids to have the confidence and skills to be independent adults. I can’t predict what will happen to my kids in the future, but since working through Beyond Personal Finance, I know they have the financial literacy to face future challenges.

16. Navigating Major Purchases

Beyond Personal Finance has students walk through purchasing their first car, and then later upgrading that car. They also purchase a home, get married, start a family, while incurring all of the expenses that go along with those purchases and life events.

17. Encouraging Long-Term Financial Planning

This course wraps up after teens have experienced, on paper, at least twenty years of working and making financial decisions leading to retirement.

They are encouraged to think about what they would like their retirement to look like. It ties all of the lessons together while encouraging them to live within their means.

Getting to see the long term consequences of their decisions now will hopefully help them avoid experiencing them in real life. Students are encouraged to make wise choices at the moment, so they can build a secure and bright future.

My View: Financial Literacy for High School Students

Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum stands out among financial literacy programs for teens. It offers an immersive, hands-on experience for individuals seeking to improve their financial literacy.

Unlike traditional financial education methods, this platform engages my teens in realistic financial scenarios. These are ranging from budgeting and investing to managing debt and planning for retirement.

I appreciate that by simulating these real-life situations, Beyond Personal Finance allows teens to make decisions and see the immediate and long-term consequences of their choices. All in a safe, risk-free environment.

Teens financial literacy is an important part of any homeschooled high schooler’s curriculum. You may be unsure of how to teach financial literacy to high school students. Or perhaps you can’t decide on financial literacy topics for high school students.

Get started on Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum. Beginning teaching personal finance for teens will set them up for a good financial future.

Teens Financial Literacy Frequently Asked Questions (FAQ)

Q. What is Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum?

A. Beyond Personal Finance Teen is a self-paced, online curriculum designed to teach teens aged 13 and older about financial literacy. It covers essential financial topics such as debt, budgeting, saving, investing, and much more through interactive and realistic scenarios.

Q. Why is financial literacy important for youth?

A. Teaching financial literacy to teens is crucial as it equips them with the knowledge and skills to manage their finances effectively. This education helps them make informed decisions about careers, spending, saving, investing, and preparing for major life events, thereby setting them up for financial success in adulthood.

Q. What topics does the Beyond Personal Finance curriculum cover?

A. The curriculum covers a wide range of topics, including:

- Debt management

- Budgeting

- Saving

- Investing

- Career exploration

- Planning for major life events (buying a car, purchasing a home, starting a family)

- Managing credit cards and credit scores

- Filing income taxes

- Long-term financial planning and retirement

Q: How does the curriculum simulate real-life financial scenarios?

A: The curriculum uses 20 video-based lessons that immerse students in realistic financial situations. Teens choose careers, calculate starting salaries, plan budgets, and make financial decisions that impact their hypothetical futures. This hands-on approach helps them understand the consequences of their choices in a risk-free environment.

Q: How does the course teach budgeting and managing expenses?

A: The course provides practical budgeting tools that help teens understand income and expenses. It guides them in creating realistic budgets, factoring in potential overtime or additional income needed to meet their financial goals. This hands-on experience gives them a unique perspective on managing their finances effectively.

This post is all about teens financial literacy.

Other posts you may like:

10 Great Reasons to Use Virtual Science Labs for Homeschool – My Homeschool with a View

Homeschool Curriculum Guide – My Homeschool with a View

Excellent Self-Paced Geometry for Homeschool with Mr. D Math – My Homeschool with a View